DOMiNO Effect

for Better Future

Backing Emerging Founders Who Build Beyond Borders

Bold Moves Shift The Future

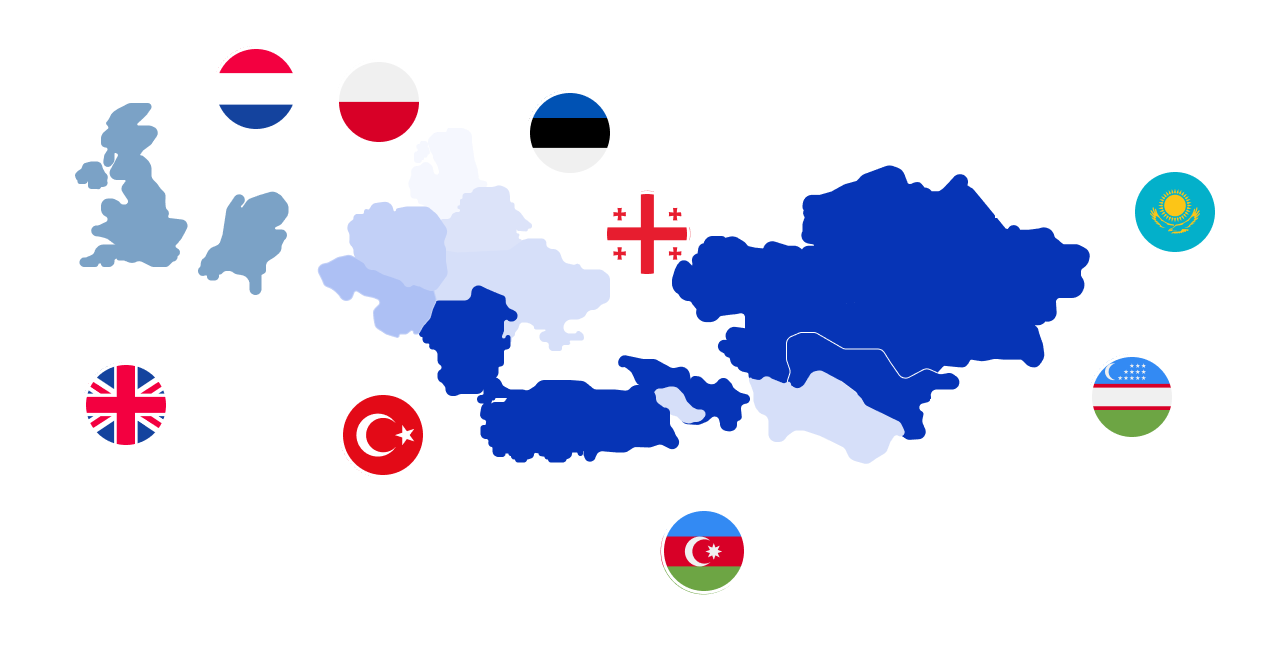

We back high-tech, pure-digital, and first-day global startups led by founders obsessed with finding innovative ways to build a Better Future with the DOMiNO Effect. We support outstanding technology founders from Eastern Europe, Central Asia and the Caucasus to help them realize their global ambitions.

Never too early. Never too late.

We invest from Seed to Series B, backing globally ambitious founders from emerging talent hubs.

We may not invest at the idea stage, but it’s never too early to start the conversation. And it’s never too late to find the right partner for your next round. We’re long-term allies. Even before we invest, we stay close, share what we know, and support where we can. When the time is right, the DOMiNO Effect begins.

In your Corner. Every Step.

Beyond Sectors. Into Scale

We’re looking for high-tech, pure-digital and first-day global startups and the big brains behind them. It’s not just about the category, it’s about clarity of vision and the courage to scale it fast.

Global Presence with Deep Roots

DOMiNO has presence where global ideas take shape. We follow talent across borders especially where ambition meets efficiency. From emerging regions to global markets, DOMiNO is there.

Build the Ecosystem. Fuel the Future.

We are creating tech transfers for each investment and keeping the tech professionals in emerging countries. We curate special programs with local investors landscape, government agencies and key industry stakeholders.

DOMiNO Impact for Better Future

The Better Future Goals (BFGs) represent our strategic commitment to fostering a sustainable future through targeted investments in innovative solutions that address pressing environmental issues and promote social progress.

The three pillars of our impact commitment through

8 BETTER FUTURE GOALS

MAKING

AS A VC

Accelerating Emerging Talent

BetterFuture AI Acceleration Program is curated by the DOMiNO Ventures team to make an impact on the startup ecosystem of Central Asia and Caucasus. BetterFuture AI Acceleration offers the chance to get an equity investment, access a wide range of global investors, and gain a valuable skill set to be used global startup arena.

Oppurtunity

Investor Network

Soft Skills

Strong Network

The DOMiNO Effecters Platform

Our Portfolio

Thougths of Our Founders

Clarity. Ambition. Precision. Respect. Impact.

At DOMiNO, our mission is to back bold founders and create the DOMiNO Effect for Better Future. These five values guide everything we do from how we choose our partners to how we show up for them. They reflect who we are, what we stand for, and how we build together.

Recent Insights

Recent Insights

Working on something big? We're all ears.

The best way to reach us is via someone we mutually know. You can always email us directly at apply@dominovc.com

Looking to invest in bold ideas for a Better Future?

The best way to invest with us is through shared vision and bold ambition, if you’re ready now, our funds and portfolio are open to those ready to shape the future. Let’s invest in it together.

Frequently Asked Questions

We back high-tech, pure-digital, and first-day global startups with strong origins in Eastern Europe, Central Asia, and the Caucasus. We focus on globally ambitious, technically grounded founding teams — especially those from the region’s local or diaspora talent pool.

We are backing founders who are solving new problems of the modern world in AI, Deeptech, Cleantech, Healthtech, Fintech, HRtech, Edtech, Gametech, Cybersecurity, and Life Sciences, with the ambition to create a DOMiNO Effect for Better Future.

We look for first-day global thinkers with international focus, in-house tech capabilities, and lean teams — with the potential to reach minimum $10M ARR with less than 50 team members within 5 years.

We invest from Seed to Series B, with initial ticket sizes typically ranging from €200K to €1M, depending on stage and structure.

We reserve over 60% of our fund for follow-ons, so we’re not just there for the first round — we back our best-performing teams across multiple stages.

When things are working, we double down. We’ve backed several of our portfolio champions in up to three rounds.

We aim to be long-term allies, scaling alongside founders through every phase — from early traction to global breakout.

Generally, no — we don’t invest at the idea stage.

But we love connecting early, even before there’s a round. Some of our strongest partnerships started this way.

We believe that early conversations and long-term relationships lead to better outcomes — whether we invest now or later.

We invest in frontier-focused, future-defining technology — and the people bold enough to build it.

Our sector focus includes Applied AI, Deeptech, Cleantech, Healthtech, Fintech, Cybersecurity, and beyond.

We’re especially drawn to mission-driven founders solving global problems with elegant tech and lean teams. It’s not just about the category — it’s about clarity of vision and the courage to scale it fast.

What sets DOMiNO apart is our belief that world-class founders can come from anywhere — and the future will be built by those bold enough to bridge worlds.

We back diaspora and frontier founders building from Eastern Europe, Central Asia, and the Caucasus — often quietly, far from the spotlight — and help them scale into global leaders.

We don’t wait for consensus.

We spot edge.

We commit early.

And when we do, we bring our platform, our people, and our playbooks to help multiply momentum — not just capital.

We’re not just investors — we’re ecosystem builders.

We’re not in the business of chasing trends.

We’re here to spark movements — one founder at a time.

We don’t just write checks. We activate conviction, unlock ecosystems, and create the DOMiNO Effect for Better Future.

We often co-lead or follow strong leads — but we never fly solo.

We prefer rounds with a strong mix of investors, especially other international VCs who can add global reach, credibility, and perspective.

We believe founders do best when surrounded by a supportive, high-trust syndicate — and if DOMiNO is in, we’ll bring others with us.

We’ve introduced portfolio founders to dozens of trusted VC partners across our network — and we love doing it.

The biggest shifts start small — with one founder, one breakthrough, one brave decision.

The DOMiNO Effect begins when we stand behind founders who are ready to lead change at global scale.

It’s about unlocking human potential, activating long-term growth, and proving that global leadership can begin anywhere.

We back those who dare to solve the modern problems of the world with clarity, conviction, and the ambition to build a Better Future.

From sustainability to AI, from climate to health — when the right founder meets the right partner, everything scales.

You start a movement.

We help it compound.

That’s the DOMiNO Effect for Better Future.

We’re hands-on — not just when things go right, but especially when they don’t.

We support hiring, fundraising, expansion, and strategic growth.

Yes, we offer operators, mentors, tools, playbooks, and our Effecters Platform — but our real value is how we show up: with clarity, momentum, and deep care for the journey.

The best way to reach us is through a warm intro — ideally from a founder or investor we already know.

But if that’s not possible, we’re always open to hearing from ambitious founders directly.

📩 effect@dominovc.com

It depends on the round and stage — but when there’s strong alignment, we move fast.

Some rounds close in just a few days. Others take longer. Either way, we keep the process clear, respectful, and efficient.

Yes — many solo founders we’ve backed had deep product insight and the ability to attract strong teams.

Solo doesn’t mean alone. We back founders with leadership potential.

Yes — especially when there’s at least one founder from Eastern Europe, Central Asia, or the Caucasus on the team.

We love diaspora founders who build from global hubs while staying connected to their roots.

We often invest in startups based in the US, UK, or EU, with technical and operational teams in our core regions.

This structure enables startups to scale faster, attract global capital, and optimize burn — while keeping execution strong.

Of course.

We love getting to know founders early — before the pitch deck, before the funding pressure.

Long-term trust leads to better alignment when the time comes.

We look for founders who lead with clarity — sharp thinkers who don’t follow trends, but build with bold conviction.

We’re drawn to ambition — not just big markets, but the courage to aim high, adapt under pressure, and keep going when things get hard.

We value precision — founders who care deeply about how things are built, not just what they become.

We admire respect — for the journey, the people involved, and the weight of building something that matters.

And above all, we look for impact — founders who want to change the world, not just their valuation.

If you build with these values, we’re already aligned.